Chapter 2 Forming Your Dropship Business

Step-by-step guidance on setting up your dropshipping business. From choosing a niche to registering your brand, get started on building your dream.

Introduction to Forming a Dropshipping Business

If you want to enter the ecommerce market then starting a dropshipping business is a very good option. Dropshipping allows you to start with minimal upfront costs as you can sell products without keeping the inventory. If you want to achieve long term success then setting up dropshipping business correctly is important. To start with, the key steps is choosing the right business structure such as LLC, Sole Proprietorship, and also handling legal setup. Doing this will ensure protection from liability and will also simplify tax obligations. When you are establishing a formal dropshipping business the first step is to register your company followed by obtaining licenses, and setting up contracts with suppliers. Tools like Flxpoint business integration can streamline operations for growth and efficiency.

Step-by-Step Guide to Formally Establishing Your Dropshipping Business

Let’s begin with choosing the business structure as it is the foremost step followed by the registration of your business.

Choosing a Business Structure

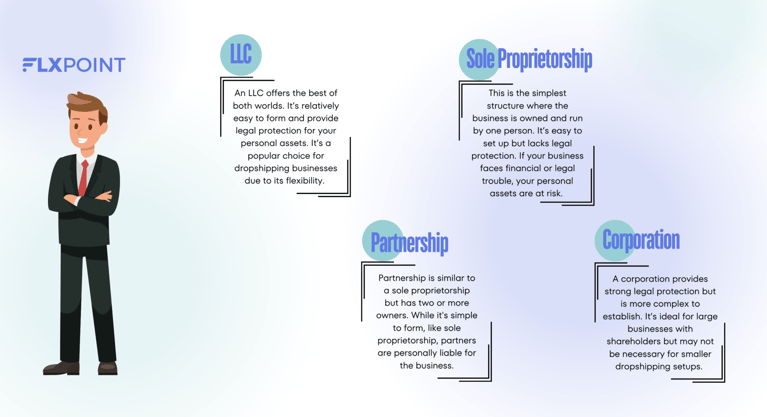

Every business starts with the first step and in dropshipping, the first step is choosing the right business structure. The four common types are – LLC, Sole Proprietorship, Partnership, and Corporation.

LLC

An LLC offers the best of both worlds. It’s relatively easy to form and provide legal protection for your personal assets. It’s a popular choice for dropshipping businesses due to its flexibility.

Sole Proprietorship

This is the simplest structure where the business is owned and run by one person. It’s easy to set up but lacks legal protection. If your business faces financial or legal trouble, your personal assets are at risk.

Partnership

Partnership is similar to a sole proprietorship but has two or more owners. While it’s simple to form, like sole proprietorship, partners are personally liable for the business.

Corporation

A corporation provides strong legal protection but is more complex to establish. It’s ideal for large businesses with shareholders but may not be necessary for smaller dropshipping setups.

Pros and Cons of Each Structure for Dropshipping

| Business Structure | Pros | Cons |

| LLC (Limited Liability Company) |

|

|

| Sole Proprietorship |

|

|

| Partnership |

|

|

| Corporation |

|

|

Importance of Selecting the Right Business Structure for Legal Protection and Tax Purposes

The four common business structures have different and unique benefits and starting a dropshipping business requires a right structure. With every choice you make it will affect the legal protection tax obligation and risk management. Tools like Flxpoint business integration can help streamline inventory management and business processes as your company grows.

Registering Your Business

The second step after choosing the business structure is to register your business. This process ensures you’re compliant with local, state, and federal laws. Below are the steps you should follow to register your business:

Steps to Officially Register Your Dropshipping Business

- Choose the right business structure (LLC, Sole Proprietorship, etc.).

- Pick a unique business name that reflects your brand.

- Check the availability of the business name with state and federal databases.

- Register for a business license or permit based on your location.

- Apply for an Employer Identification Number (EIN) for tax purposes.

- Open a business bank account to separate personal and business finances.

Choosing a Business Name and Ensuring it’s Available

Selecting the right business name is the most important part of branding. It reflects the core of your business. Make sure that you select a unique and easy name with no double letters that are in sync with your products. Before selection, ensure that the name is not used previously. You can search through the state’s business registry and the U.S. Patent and Trademark Office. Pick up the same domain name as your selected name.

Filing Paperwork with Local or State Authorities

Once you’ve selected a name and decided on a business structure, the next step is to file the necessary paperwork with local or state authorities. This usually involves submitting articles of incorporation if you’re forming an LLC or corporation. You may also need to apply for business permits, depending on your industry and location. Proper filing is key to making your dropshipping business legitimate, so make sure you follow all legal setup procedures.

Legal Considerations for Dropshipping Businesses

Obtaining Necessary Licenses and Permits

As a dropshipping business holder, you need to have a proper legal setup and licenses to operate. Depending on your location and the products you sell, various licenses and permits may be required.

Explaining the Business Licenses Required for Dropshipping

- General Business License – Most businesses need a standard license to operate legally within their city or county.

- Sales Tax Permit – If you’re selling physical goods, you may need a permit to collect sales tax from customers.

- Reseller’s Permit – This allows you to buy goods tax-free from suppliers when you plan to resell them.

- Special Licenses for Regulated Products – Some products (like firearms or alcohol) may need additional permits.

Researching and Applying for Local, State, and Federal Licenses

It’s important to research and apply for the necessary licenses at the local, state, and federal levels. Start by checking your local government’s website for requirements and contact the appropriate department. State licenses vary depending on where your business is located and the products you sell. Certain federal regulations may also apply, especially if you deal with international suppliers.

Importance of Staying Compliant with Local Business Laws

Compliance with local laws is crucial to avoid penalties or the risk of shutting down your business. Regularly review your local regulations to ensure you’re up-to-date with any changes. Staying compliant helps protect your business and builds trust with customers and suppliers.

Tax Implications of a Dropshipping Business

One of the most important factors to consider is how taxes will impact your business. Different business structures, like LLCs or Sole Proprietorships, have unique tax obligations, and understanding these is essential for compliance.

Overview of Tax Obligations for Different Business Structures

The tax obligations of your dropshipping business depend on the business structure you choose. For instance, a Sole Proprietorship means the business income is taxed as personal income, while an LLC offers more flexibility and may separate business income from personal taxes. Corporations are taxed separately from personal income, which might be more favorable in certain cases. Choosing the right structure affects not only your taxes but also your liability protection.

Sales Tax Collection and Nexus Considerations

Sales tax can be tricky in dropshipping. In most cases, you’ll need to collect sales tax from customers based on your “nexus.” Nexus is the connection your business has to a particular state, typically determined by having a physical presence, employees, or a substantial volume of sales. If you have nexus in a state, you’re required to collect sales tax from buyers in that state. Staying compliant with state tax laws is important.

How to Handle Taxes When Working With International Suppliers

Here are some ways to handle taxes when working with international suppliers:

- Understand tax obligations for imports and customs.

- Be aware of VAT and international sales taxes

- Consider using tools like Flxpoint business integration to manage cross-border taxes efficiently.

Contracts with Suppliers

Importance of Having Formal Contracts with Dropshipping Suppliers

For a dropshipping business, a formal contract with the supplier is mandatory and essential. A contract sets clear expectations between both parties and protects your business from potential legal disputes. Without a contract, you risk issues like delayed shipments, product quality problems, or suppliers failing to fulfill orders. A strong agreement ensures transparency and accountability, which is crucial for maintaining a good reputation with your customers. It also helps secure your business in cases of product liability or returns, providing legal recourse if necessary.

Key Terms to Include in Supplier Agreements – Product Liability, Shipping Times, And Return Policies

- Product Liability – Suppliers should be responsible for the quality and safety of the products.

- Shipping Times – Ensure clear timelines for shipping to avoid delays.

- Return Policies – Define how returns are handled and who bears the cost.

Negotiating Favorable Terms with Suppliers to Protect Your Business

- Negotiate minimum shipping times to ensure fast delivery.

- Agree on acceptable product quality standards to avoid customer dissatisfaction.

- Secure flexible returns and refund terms to protect your profit margins.

Setting Up Financials and Payment Systems

Business Bank Account and Accounting

Setting up your finances and payment systems is one of the most important aspects. This is to ensure smooth operations, legal compliance, and separating personal and business finances.

Importance of Separating Personal and Business Finances

Mixing personal and business finances can lead to confusion and tax implications. It becomes hard to track expenses, revenue, and profits when both are combined. Separating them protects your personal assets and ensures you stay compliant with tax laws. Additionally, this separation strengthens the legitimacy of your business structure, especially if you choose to form an LLC or corporation. Keeping finances separate also simplifies accounting and makes it easier to identify profit margins and areas of financial growth.

Setting Up a Business Bank Account for Tracking Income and Expenses

- Open a dedicated business bank account as soon as you register your dropshipping business.

- Use this account for all business-related transactions, including paying suppliers and receiving payments from customers.

- A separate account will help in keeping accurate records for taxes and financial reporting.

Basic Accounting Practices for Dropshipping Businesses

- Track income and expenses consistently to monitor your business’s financial health.

- Use accounting software to automate the process of recording transactions and managing finances.

- Prepare for tax season by organizing receipts, invoices, and bank statements.

- Regularly review your profit margins and adjust pricing if necessary.

Choosing Payment Gateways

Selecting Secure and Efficient Payment Gateways for Your Ecommerce Store

A payment gateway is a service that processes credit cards, debit cards, online payments, and other types of transactions on your ecommerce store. The most popular options include PayPal, Stripe, and Square. Choose the one that integrates well with your ecommerce platform and supports multiple payment methods, like credit cards, digital wallets, and bank transfers.

Considerations for Transaction Fees and Security Measures

Transaction fees vary between payment gateways and can impact your profit margins. Some gateways charge a specific percentage per transaction, while others may have monthly fees. It’s important to consider these costs when selecting the best gateway for your business. Also, security is critical. Ensure that your payment gateway is PCI-DSS compliant. It means that it follows strict security standards to protect customer data. SSL certificates and encryption measures should also be in place.

Protecting Your Business Legally

Understanding Product Liability

Even though the dropshipper does not handle products directly but is responsible if anything goes wrong, whether it is a defective product, causes harm, or doesn’t meet the customer’s expectation, you will be held responsible legally. This is why ensuring legal protection is important so you can avoid costly lawsuits.

Risks Involved with Dropshipping and Product Quality

- Limited control over product manufacturing and quality

- Inconsistent product standards from suppliers

- Delays in shipping and incorrect orders

- Poor packaging increases the risk of product damage during transit

How to Mitigate Legal Risks Through Product Liability Insurance and Supplier Agreements

To protect your business, you should invest in product liability insurance. This insurance covers legal costs and damages if your product causes harm. Additionally, having solid supplier agreements is essential. These agreements should outline responsibilities, including product quality, shipping, and returns. Negotiate terms that shift liability to suppliers for defective or harmful products. Also, using platforms like Flxpoint business integration to automate inventory management, ensures transparency in the supply chain, which can help reduce risks associated with product quality.

Return and Refund Policies

Setting Up Clear Return and Refund Policies to Avoid Legal Issues

- Create a transparent return and refund policy, and display it prominently on your website.

- Define specific timeframes for returns, such as 30 or 60 days.

- Outline conditions for eligible returns (e.g., unused products, original packaging).

- Clarify who bears the return shipping costs.

- Ensure the policy complies with local consumer protection laws.

Working with Suppliers to Ensure Smooth Return Processes

Collaborating with suppliers is vital for handling returns efficiently. Make sure they are willing to accept returned items and have systems in place for quick processing. When setting up contracts, negotiate terms regarding how returns are managed, including shipping logistics and cost-sharing. Using tools like Flxpoint business integration can help automate and streamline communication with suppliers, ensuring that both you and the customer experience fewer delays or complications in the return process.

Flxpoint Integration for Business Operations

What is Flxpoint Business Integration?

Flxpoint helps businesses automate and optimize their ecommerce operations. This is done through data automation and workflow engine technology. Flxpoint offers custom integration development for ecommerce workflows and has over 16 years of experience with EDI and API integrations. By integrating Flxpoint, you can simplify the complex tasks involved in dropshipping. For businesses that are planning to start a dropshipping business, using Flxpoint can optimize operations, reduce manual errors, and also save time. This integration supports various business structures and helps ensure compliance with legal setup.

Benefits of Integrating Flxpoint into Your Dropshipping Business

Flxpoint can help a dropshipping business by

- Streamlining Workflow – The automated workflows connect sales channels, suppliers, and inventory.

- Unifying Data – Flxpoint’s distributed inventory management brings data from various sources together, creating a unified, streamlined version in one place.

- Improving Efficiency – Flxpoint’s centralized data offers clear insights, enabling informed decision-making.

- Automating File-Based Integrations – Flxpoint’s “no code” mapping tool can automatically import or transmit files through FTP, email, or direct HTTP links without requiring any coding skills.

- Offering Pre-Built Integrations – Flxpoint provides access to more than 250 ready-made integrations with dropshipping suppliers.

- Providing a Virtual Assistant Service – Flxpoint provides a virtual assistant service that assists with integration management, order tracking, product listings, and other tasks.

Conclusion

In conclusion, forming your dropshipping business requires careful planning and execution. You need to choose the right business structure, understand legal requirements, and ensure proper contracts with suppliers. A solid legal setup protects your business and sets a strong foundation for growth. Utilizing tools like Flxpoint can streamline operations, making it easier to manage your dropshipping processes. By following these steps, you can successfully launch and sustain a thriving dropshipping venture.

Guide Chapters

- Chapter 1: Introduction to Modern Dropshipping

- Chapter 2: Forming Your Dropship Business

- Chapter 3: What to Sell Online - How to Find the Right Products

- Chapter 4: Product Sourcing and Supplier Integration

- Chapter 5: Inventory Management for Dropshipping

- Chapter 6: Dropship Pricing Strategies

- Chapter 7: Fulfillment and Automation for Scaling

- Chapter 8: Hybrid Dropshipping - Combining Wholesale & Dropshipping

- Chapter 9: Avoiding Dropshipping Scams

- Chapter 10: Integration of Advanced Technologies - EDI & API

- Chapter 11: Leveraging Data for Better Decision Making

- Chapter 12: Automating Your Workflow for Maximum Efficiency

- Chapter 13: Managing Multi-Channel Sales and Integration

- Chapter 14: Expanding and Scaling Your Dropshipping Business

- Chapter 15: Troubleshooting Dropshipping Challenges with Advanced Tools

- Chapter 16: The Future of Dropshipping with Technology

All Chapters in This Guide

Unpack the evolution of dropshipping and why it’s still one of the most effective ecommerce models. Learn how the modern approach is different from outdated methods, what’s fueling its explosive growth, and what it takes to succeed in today’s competitive market.

Get step-by-step guidance on building a strong foundation. From choosing your niche and validating your business idea to setting up your brand and making it legit—this chapter gives you the tools to confidently launch with clarity and purpose.

Struggling with product selection? Discover how to find winning products that sell. We cover techniques for identifying trends, analyzing competition, using supplier insights, and narrowing down product ideas that fit your niche and audience.

Not all suppliers are created equal. This chapter shows you how to source high-quality products and onboard suppliers the smart way. Learn how to vet vendors, avoid bad partnerships, and set up seamless integrations that keep your fulfillment running like clockwork.

Say goodbye to stockouts and overselling. Learn how to keep your inventory accurate and your customers happy with real-time updates, smart syncing, and automated stock management across all your channels and vendors.

Pricing isn’t just numbers—it’s strategy. Dive into methods like cost-plus, value-based, and psychological pricing to find the sweet spot between profitability and competitiveness. You'll also learn how to handle MAP policies and dynamic pricing changes.

Manual processes holding you back? Discover how to automate your order routing, fulfillment, and vendor communication. Whether you’re dropshipping from a single source or juggling multiple suppliers, we’ll show you how to build a fulfillment engine that scales effortlessly.

The best of both worlds. Learn how to blend dropshipping with traditional wholesale to create a hybrid fulfillment model. Diversify your supply chain, increase margins, and reduce risk—all while maintaining flexibility and speed.

Protect your business (and your sanity). This chapter highlights red flags to watch for when sourcing suppliers, how to avoid fake vendors, and what to do if something seems off. Learn to build a trustworthy and secure supply chain from day one.

Tech made simple. Understand how using EDI and API integrations can automate communication with suppliers, speed up order processing, and reduce costly errors. Whether you're tech-savvy or not, this chapter makes complex systems feel doable.

Smart businesses run on data. Learn how to track key ecommerce metrics, monitor supplier performance, and analyze product performance to make confident, data-driven decisions that boost sales and efficiency.

Unlock time-saving workflows that work while you sleep. This chapter breaks down how to automate inventory syncing, order routing, vendor communication, and customer updates to run your business like a well-oiled machine.

Ready to expand beyond one platform? Learn how to integrate and manage listings, inventory, and orders across multiple sales channels—like Shopify, BigCommerce, Amazon, Walmart, and more—without doubling your workload or making costly mistakes.

When it’s time to grow, this chapter shows you how. From onboarding new suppliers and expanding product lines to optimizing your tech stack and improving operations, get a roadmap for scaling sustainably and profitably.

Every business runs into roadblocks—what matters is how you respond. Learn how to tackle issues like supplier delays, low inventory, and customer service hiccups using smart tools, real-time alerts, and proactive troubleshooting strategies.

What’s next for dropshipping? Explore emerging trends like AI-powered automation, predictive inventory, autonomous fulfillment, and more. Stay ahead of the curve and future-proof your business with the latest innovations.

Kenneth Cole's Smart Savings With Shopify EDI Connections

"They had never used Flxpoint before. But working with [the Flxpoint] team, they learned it and we're about to onboard our newest footwear partner, and you know that's big business for us.”

Mitul PatelKenneth Cole

How Flxpoint Helped Rifle Supply Automate & Grow

“I went line by line… whatever the inventory number was and cost value was, I calculated it and was blown away by how much that was worth— $300 million worth of product that I added to our web store.”

Chris MekdaraRifle Supply

The Ecommerce Automation Behind Screen Skinz

"Automation is the key to maximizing your volume. [Flxpoint] comes right into our flow — everything's automated. We want it to be quick and efficient. So that's what we love about Flxpoint."

Shaun Brown & Clay CanningScreenSkinz

How Inhaven Transformed Vendor Management with Flxpoint

"We ended up switching to Flxpoint, and it has been a much smoother process. Where it took us six months to get onboarded with the other company, we were up and running in a week or two with Flxpoint."

Ashley ChingInhaven

How Black Patch Performance Scaled Smarter with Flxpoint

"The only way to actually scale was to go through Flxpoint… You can’t even come close to hiring someone to do what Flxpoint does for the price."

Jonathan WilliamsBlack Patch Performance